Charts

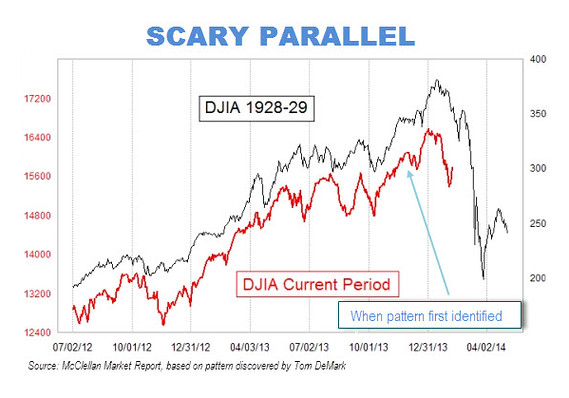

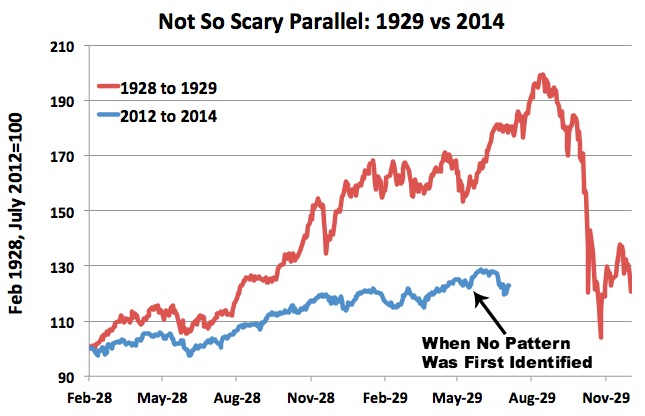

Examining charts is a long-standing fixture of modern finance. For example, we have all seen “scary charts”, which often spread like viruses. One example is the following (first chart). But as Matthew O’Brien pointed out, the scary parallel pretty much disappears if one scales the two charts properly (second chart):

Technical analysis

Charting typically goes hand-in-hand with “technical analysis,” namely the usage of relatively unsophisticated analysis schemes, typically computed from high-level statistics on stock market data. The field has its own terminology, as exemplified for example by a recent report in the Concord Register: parabolic stop and reverse or “PSAR.,” average true range or “ATR,” relative strength index or “RSI,” average directional index or “ADX,” Williams percent range or “Williams %R,” stochastic oscillator and channel commodity index or “CCI.” (Web links here are to Investopedia.com articles that explain the term.)

Just a few of the prominent market analysts that either promote technical analysis or, at the least, employ technical analysis or related methods (charting, waves, cycle analysis, market timing, etc.) in their work include the following: Bernie Schaeffer, Bob Brinker, Carl Swenlin, Clif Droke, Curt Hesler, Dan Sullivan, David Nassar, Dennis Slothower, Don Hays, Gary Kaltbaum, Gary Savage, James Dines, Jason Kelly, Jim Cramer, Jim Jubak, Jon Markman, Louis Navellier, Mark Arbeter, Martin Goldberg, Mike Paulenoff, Nadeem Walayat, Peter Eliades, Price Headley, Robert McHugh, Robert Prechter, Steve Saville, Tim Wood, Tobin Smith, Tom DeMark.

Can technical analysis successfully forecast the market?

The technical analysis community certainly has command of the financial news world — it is hard to read any online financial news source without seeing at least some articles of this genre. More importantly, many individual investors, pension funds, mutual funds and other organizations routinely use technical analysis methods in their market analysis and decision making.

But do these methods really work? Do they really deliver consistently above-market-index results? Market analyst Laszlo Birinyi, interviewed in the book The Heretics of Finance, wrote, rather bluntly, “The truth is technical analysis doesn’t work in the market.” He has shown, for instance, that anyone who relied on the advance-decline ratio would have remained out of the market entirely from 1957 until 2002.

The present bloggers, together with Amir Salehipour and the late Jonathan Borwein, recently completed the study Evaluation and ranking of market forecasters, which analyzed the records of 68 market forecasters, based on data earlier collected by CXO Advisory, and employing a novel weighting scheme that took into account how specific the forecasts were. Each of the 27 technical analysts (except for Tom DeMark) mentioned in the list three paragraphs above were part of this study. Indeed, these 27 were selected for analysis here, based on our checking each one of the 68 in the earlier study as to whether or not technical analysis and related methods appeared to be a significant part of their methodology.

So how well did the technical analysts do? Their average precision score was 44.1% — in other words, less than even chance. In fact, this average score was slightly less than the average of all 68 forecasters in our earlier study. In short, there is no evidence whatsoever in our data that technical analysis is effective in predicting markets. If anything, our results must be on the optimistic side, because of the well-known survivorship bias phenomenon — very likely numerous unsuccessful technical analysis practitioners have dropped out of the business, and thus are absent from our tables.

Cargo cults

The twentieth century saw the rise of cargo cults in the Melanesian islands of the Pacific. Natives of these islands were thrust rather suddenly into the modern world with the arrival of military troops and equipment during World War II, both from the Japanese and the Allied sides. When the war ended, these troops and their western goods just as suddenly disappeared, leaving some natives disappointed and yearning for their return. Anthropologists later noted that natives had constructed items reminiscent of what they had seen, including headphones carved from wood, runways, jerry-rigged “control towers” and more, all in the hope that somehow these items would facilitate the return of the military vessels and their cargo.

On Vanuatu Island, for example, a cult arose revering someone named “John Frum,” which was later thought by some researchers to be a linguistic corruption of “John from America.” Followers of this movement, which continue to this day, are convinced that John Frum will return.

In a similar way, many practitioners of technical analysis continue to practice their craft, year after year, when there is precious little, if any, solid statistical evidence, free from backtest overfitting (which sadly is very widespread in the finance field), that these methods consistently work in today’s high-tech markets. Practitioners seem to think that if they continue to diligently practice the outward trappings of their craft (analyzing charts, using technical terminology, etc.), that eventually significant above-market rewards will return.

But there is no reason to be optimistic. After all, nowadays a large fraction (over 80%) of all trades are executed not by individual investors or even most institutions, but instead by highly computerized operations (often operated by large mathematically-oriented hedge funds) that employ extremely sophisticated mathematical analysis, running on state-of-the-art computer systems, operating on huge datasets, to wring every morsel of potentially profitable information out of market data, and to act on their analyses in millisecond or even microsecond time frames. Recently some of these operations have extended their operations beyond market data to include econometric data, consumer transaction data, satellite images, and even social media posts. Future systems operated by these organizations are certain to be even more sophisticated than those being used today.

So how can human analysts, eyeballing charts and using simple formulas and statistical tools, possibly compete with such overwhelming firepower? The answer is obvious: they can’t.

In ancient Egypt, Ptolemy I studied Euclid’s Elements (a treatise on plane geometry). When he found it rather difficult, he asked Euclid if there was an easier way to master it. Euclid famously replied Sire, there is no royal road to geometry.

The same is true today: there is no royal road to investment — there is no simple, easy-to-understand scheme, whether it be charting, technical analysis, wave analysis, or anything else, that can consistently achieve above-market-index results. For individual investors especially, nothing can take the place of patient, long-term, diversified, low-fee investment.