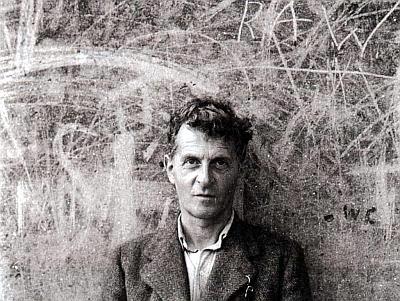

It is not often that one hears the name of Ludwig Wittgenstein (1889-1951) mentioned in an investment forum. Perhaps it is because the great Anglo-Austrian positivist philosopher gave away his entire inheritance at the age of 30. Quite a brave thing to do, having been born into one of Europe’s wealthiest families, with a fortune comparable to that of the Rothschilds.

You see, Ludwig wanted a do-it-yourself life, he wanted to achieve something based on his own merit. Three of his brothers committed suicide, and poverty probably saved his life and mind (“Tell them I’ve had a wonderful life”).

By his late years, he had been acknowledged as on of the greatest twentieth Century philosophers, the author of the 75-page Tractatus Logico-Philosophicus (1921). In that work, Ludwig discusses the relation between language and reality (“whereof one cannot speak, thereof one must be silent”).

Wittgenstein had wished for an unrealized joint publication of Tractatus and his other greater work Philosophical Investigations (1953), see the Wittgenstein controversy, suggesting the two seemingly antagonistic volumes are reconcilable. He had hoped for the epithet of “It’s generally the way with progress that it looks much greater than it really is.”

“I am not interested in erecting a building, but in presenting to myself the foundations of all possible buildings.” Ludwig Wittgenstein.

What does this have to do with investing?

First, Wittgenstein re-purposed formal logic. Logic sounds like a good thing to keep in mind when evaluating an investment advice.

Second, an investment advice is a work of language, a set of rules that promise riches to the listener. One would hope that there is some hard reality in that language, or the outcome may be quite disastrous.

Third, Wittgenstein was an expert in “logical series.” If you have ever taken an I.Q. test, you are probably familiar with them. A logical series contains the beginning of a pattern, and the poor soul sitting at the test must complete it. Most investment advices are formulated as logical series, such as “every time x and y have occurred, z has followed.” Wittgenstein would have been a great investor, but as we have already explained, the man had no use for money.

And here is what Wittgenstein wrote in Section 201 of his posthumous Philosophical Investigations:

“This was our paradox: no course of action could be determined by a rule, because every course of action can be made to accord with the rule.”

What Wittgenstein is reminding us is that, among other things, rule-based investing is flawed.

Take a random sequence of events, and he will come up with a rule that continues the sequence in logical terms. The rational investor, aware of this situation, would not follow any investment advice. But then, why is it that investment advisers are still in business? Well, let’s say that superstition is alive and well in the 21st century.

Going back to the point, what can we do about it? Is there no hope for investors, can no rules be trusted? Note that Wittgenstein’s paradox was established in the context of human language. He had nothing to say regarding mathematical statements, which in the view of Immanuel Kant, are a form synthetic a-priori knowledge. In the Queen’s English, this means that a mathematical result reaches a conclusion that is true without and independent of empirical experimentation. It is true because it is the necessary and unavoidable consequence of a set of axioms.

This is easy to verify. Consider that, during your high school years you were fortunately never taught Greek Chemistry, or Greek Physics or Greek Biology. However, no matter in what part of the modern world you live, dear reader, if you ever attended a high-school class of Mathematics, you were instructed in Greek Mathematics: Geometry. The reason is, when Euclid proved a theorem, he did it forever.

It took a while, but Sir Isaac Newton’s physics has been proven ‘wrong’; not his mathematics. One day, Einstein will be shown incomplete. Civilizations fall, old gods are forgotten, but Euclid cannot and will never be proven wrong. And so, in another two thousand years, little kids will continue to study and understand what good old Euclid and his fellow mathematicians said and wrote. A few may even go gently mad and become Mathematicians.

Are investors hopeless?

The only hope of investors is to evaluate mathematically the accuracy of an investment advise. How?

The phenomenon that Wittgenstein is referring to (finding some logical rule for any random series) has a precise analogue in Mathematics: Overfitting. Overfitting can be understood as the phenomenon of finding a function able to explain any possible numerical series, even pure noise. Overfitting is always possible. In fact, the hard thing to do is to avoid it! But, how overfit was the investment advice you acted upon last week? Not having that piece of information should have deterred you from investing, because odds are, that advice was pure nonsense. Next time, you should calculate the Probability of Backtest Overfitting.

Remember, Ludwig Wittgenstein intentionally gave away his inheritance, at the age of 30, as an act of greatness. Do not give away your hard-earned retirement savings inadvertently… there is no greatness in that.