A new paper, Causal factor investing: Can factor investing become scientific?, has been written by our esteemed colleague Marcos Lopez de Prado of Cornell University, Abu Dhabi Investment Authority and True Positive Technologies.

In his 75-page preprint, Lopez de Prado argues that almost all journal articles in the “factor investing” literature make assertions that are merely associational observations from statistical analyses, with no attempt to connect these findings to any coherent underlying theory. In other words, these authors justify their chosen model specification merely in terms of correlations or other statistics, and they do not propose experiments for falsifying causal mechanisms. As Lopez de Prado writes, “absent a causal theory, their findings are likely false, due to rampant backtest overfitting and incorrect specification choices.”

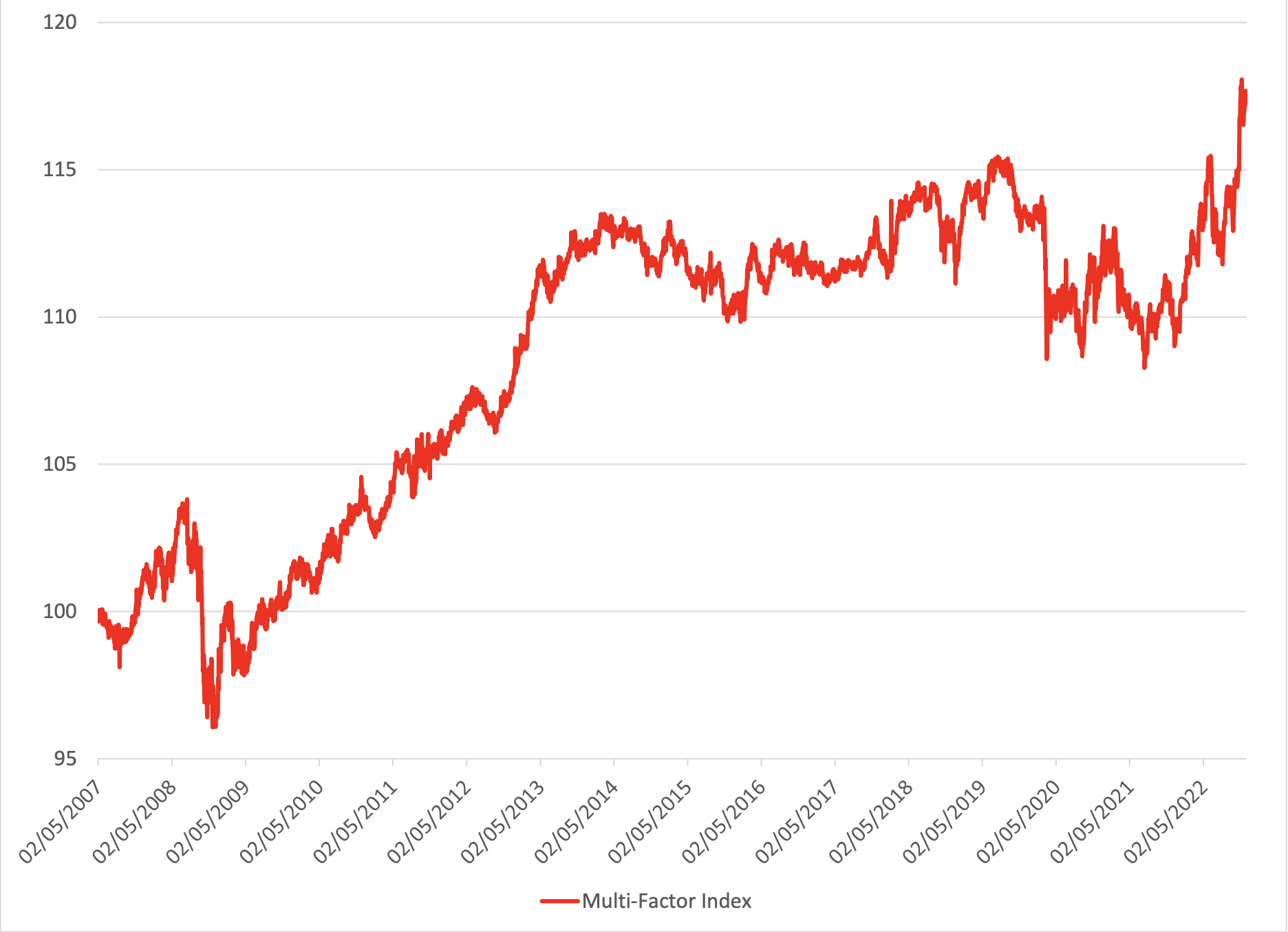

[Performance of the Bloomberg – Goldman Sachs Asset Mngt US Equity Multi-Factor Index, 2007-2022

What are the consequences of these failings? First and foremost, the actual returns to investors in factor instruments remain disappointingly low (some would say pathetically low). Lopez de Prado included the graph to the right in his paper, showing the performance of the Bloomberg-Goldman Sachs Asset Management US Equity Multi-Factor Index, 2007-2022.

At first glance, the graph outwardly seems impressive, but once one notices that this 18% or so increase is over a 15 year period, it is clear that this is a decidedly second-rate return. As Lopez de Prado notes, “After more than 15 years of out-of-sample performance, factor investing’s Sharpe ratio [0.29] is statistically insignificant at any reasonable rejection threshold.”

Lopez de Prado devotes much of his paper to discussing causal graphs and the related “do-calculus,” in an effort to provide a rigorous framework for advancing factor investing, thus raising the specialty to the level of a truly effective and scientifically falsifiable discipline. A brief outline of his paper is as follows:

- Analyzing the logical inconsistency that afflicts much of existing factor investing research literature.

- Defining two types of spurious claims: type-A and type-B, and emphasizing why it is important for factor investing researchers to distinguish between the two.

- Showing how this taxonomy may be employed to derive a hierarchy of empirical evidence used in financial research, based on the susceptibility of spurious evidence.

- Showing how Monte Carlo experiments can be designed, in part to illustrate the dire consequences of type-B spurious claims in factor investing.

- Providing an alternative explanation for the main findings of the factor investing literature, focusing on the time-varying nature of risk premia reported in some journal articles.

- Listing specific actions to rebuild factor investing on the more solid scientific foundation of causal inference.

Here is an excerpt from the Conclusion:

Financial economists’ adoption of causal inference methods has the potential to transform investing into a truly scientific discipline. They are best positioned to inject, make explicit, and argue the extra-statistical information that complements and enriches the work of statisticians. Financial economists interested in causal research would do well in partnering with non-commercial asset managers, such as sovereign wealth funds and endowments. These institutional investors are not conflicted by commercial interests, and their objectives are aligned with their beneficial owners’.

The new discipline of “causal factor investing” will be characterized by the adaptation and adoption of tools from causal discovery and do-calculus to the study of the risk characteristics that are responsible for differences in asset returns. Every year, new alternative datasets become available at an increasing rate, allowing researchers to conduct natural experiments and other types of causal inference that were not possible in the 20th century. Causal factor investing will serve a social purpose beyond the reach of (associational) factor investing: help asset managers fulfill their fiduciary duties with the transparency and confidence that only the scientific method can deliver. To achieve this noble goal, the dawn of scientific investing, the factor investing community must first wake up from its associational slumber.