Introduction

Suppose, in a national TV newscast, instead of citing data, analysis and predictions from major government agencies, the weatherperson displayed a chart of recent temperatures, noting “trends,” “waves” and “breakout patterns.” Most of us would not have confidence in such a dubious and unorthodox forecast.

Or suppose, at a medical clinic, that a cardiologist made some hand measurements of events on an electrocardiogram and noted a “triangle pattern” or “Fibonacci ratio” between them. If this were to happen, most of us would start looking for another cardiologist. [Note: The “Fibonacci ratio,” also known as the “golden ratio,” usually denotes either the value (sqrt (5) + 1)/2 = 1.6180339… or its reciprocal, namely (sqrt(5) – 1)/2 = 0.6180339… It appears in some mathematical research settings, but has no place in cardiology or financial data analysis.]

The reason that we no longer see such dubious claims from professional practitioners is that in recent years most professional fields have significantly upgraded their prevailing standards for data analysis. Simplistic analyses of charts and graphs using statistically questionable schemes are no longer acceptable in peer-reviewed science, medicine or engineering. See, for instance, this statement by the American Statistical Association. Among other things, it deplores the practice of “p-hacking,” namely testing numerous hypotheses on a single set of data until one hypothesis is found that appears to be statistically significant. See this Mathematical Investor article: P-hacking and backtest overfitting and this Math Scholar article: P-hacking and scientific reproducibility for additional details.

Technical analysis in major brokerages and financial media

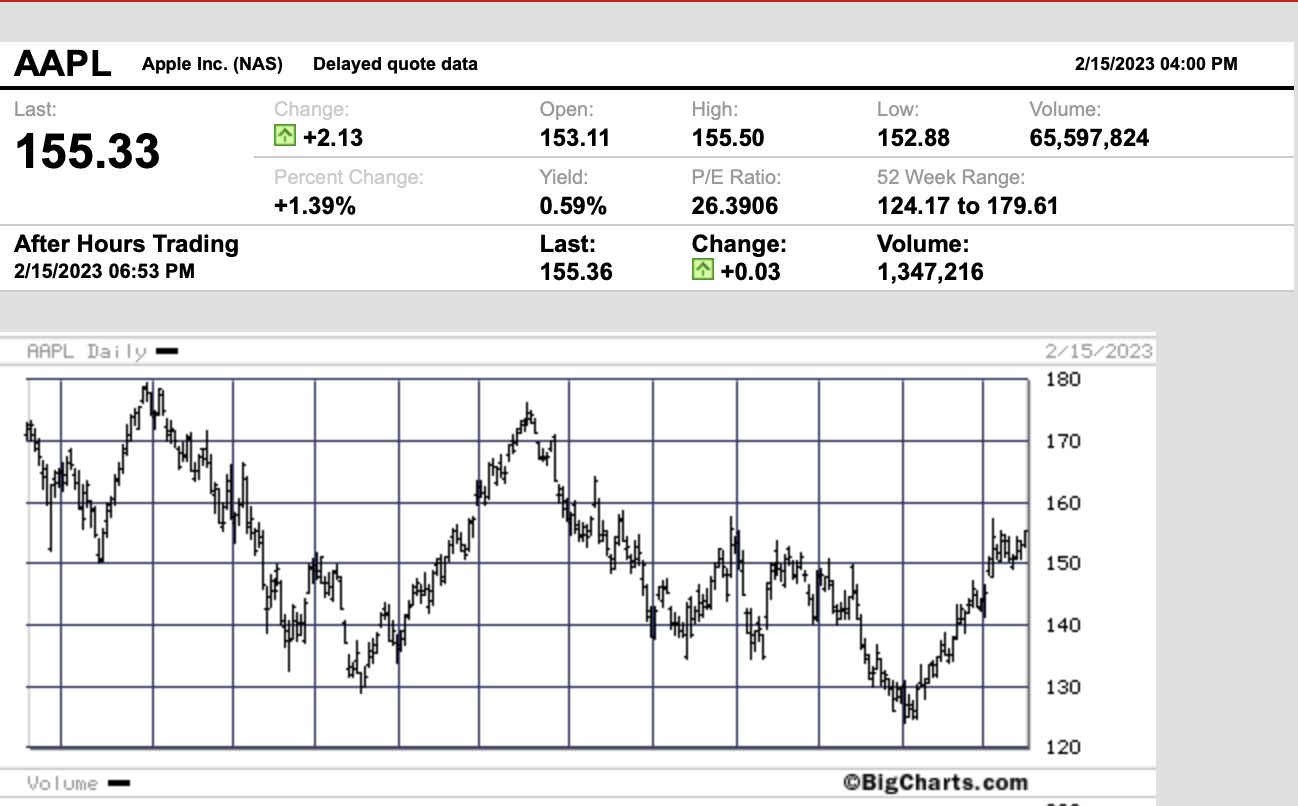

So what is one to think about the numerous major brokerages and financial media outlets that continue to promote “technical analysis,” a practice that has only a vague technical basis, makes no sense in 21st century markets dominated by highly sophisticated computerized trading operations, and which in fact was long ago demonstrated not to yield any significant market advantage? Given that “trends,” “waves,” “breakout patterns,” “triangle patterns,” “shoulders” and “Fibonacci ratios” make no sense in climatology or cardiology, why should one pay any attention to them at all in finance, much less base one’s life savings or other investments on such dubious reckonings?

In a previous Mathematical Investor article, we provided a list of weblinks and other examples of technical analysis being featured by a number of major U.S. brokerages and financial news organization. Nearly three years has passed since this article appeared, and so some of us presumed that by now the mentions of technical analysis by such organizations would be significantly receding, if not eliminated altogether.

Sadly, there is no convincing indication of a de-emphasis of technical analysis; if anything, additional material is now available. Here is a brief list of some recent weblinks, with text excerpts, highlighting material on technical analysis from the websites of a few prominent brokerages and financial news organizations, found by straightforward web searches:

U.S.-based brokerages:

- Charles Schwab:

- “Learn how the Relative Strength Index, or RSI, works and how it can help investors analyze trends.”

- “Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns.”

- Fidelity Investments:

- “The Technical Indicator Guide is an educational tool that can help you learn about the indicators and overlays that are available on Fidelity’s platforms. Technical Analysis uses historical data in order to attempt to identify future securities price movements. When used in conjunction with other technical analysis tools or fundamental analysis, it can help you identify possible entry and exit points for trades and may help you achieve your investing goals.”

- Fidelity Investments:

- “Spot trading opportunities in real-time with clear, actionable alerts from Real-Time Analytics. Be in the know when a stock hits a new high or low, crosses over a key technical level, experiences an unusual spike in intraday volume compared to its historical average volume, and more.”

- “Define entry and exit strategies, visualize a trade’s potential risk and reward on a chart, and set an alert to stay on top of price movements.”

- Merrill Lynch:

- “When it comes to evaluating investments, everyone can get technical. In this series, our presenters will provide you with the critical knowledge you need to chart, read patterns and make sense of the jargon.”

- “This introductory session will give you the foundation you need to recognize trends and make sense of chart types as well as support and resistance.”

- “In this two-part series, you will earn about trends, continuation patterns and reversals. We’ll also introduce Fibonacci, our first technical study.”

- “In the second installment, we will continue [our] discussion on trends and dive deeper into Fibonacci.”

U.S.-based financial news media:

- Barrons:

- “Two Charts That Show When the Market Will Bounce Back.”

- “When the two-year Treasury yield breaks below its 11-week moving average, yields will have made a top. A lot of the downside pressure on stocks will then lift, and the stock market should rally.”

- Bloomberg News:

- “Introduction to Charting and Technical Analysis.”

- Bloomberg News:

- “Stock-market technicals indicate that investors agree with this logic, as the S&P 500’s uptrend that started last fall continues even with the index losing 2.6% this month.”

- CNBC:

- “Watch Jim Cramer break down fresh technical analysis from Mark Sebastian.”

- “CNBC’s Jim Cramer explained new technical analysis from chartist Mark Sebastian on Friday’s episode of ‘Mad Money.'”

- Kiplinger:

- “Technical Analysis Says This Stock Market Rally Has Legs. While nothing in the market is certain, the latest chart developments suggest the S&P 500’s impressive rebound could continue in the near term.”

- MarketWatch.com:

- “The Technical Indicator: Technical analysis for sophisticated traders.”

- “Ultimate research tool for traders.”

- “Get five stocks poised to move.”

- MarketWatch.com:

- “Here’s why one technical analyst says the stock market is due a bounce after the 697-point selloff in the Dow.”

- Wall Street Journal:

- “Technical Analysis: Fibonacci Retracements. In this technical analysis tutorial, you will learn how to draw Fibonacci retracement lines and how to use these.”

- Wall Street Journal:

- “Stock investors are beginning to act like the worst is over in the coronavirus-fueled market rout. Those who rely on technical analysis say there is likely more pain ahead.”

Why technical analysis doesn’t work

In some previous Mathematical Investor articles (see for instance here), we explained why technical analysis does not work and cannot be expected to work in today’s high-tech financial markets. Here is a summary:

- Internal disagreements. One difficulty is that there is no clear, publicly acknowledged consensus within the technical analysis community as to what constitutes an actionable pattern, particularly when chart readings and interpretation rules are themselves vague and ambiguous.

- Our research studies. The present author and colleagues recently completed the study Evaluation and ranking of market forecasters, which analyzed the records of 68 market forecasters, based on data earlier collected by CXO Advisory, and employing a novel weighting scheme that took into account how specific the forecasts were. Among these 68 forecasters were 27 who acknowledge using technical analysts as a significant part of their analysis. So how well did these 27 technical analysts do? Their average precision score was 44.1% — in other words, less than even chance. In fact, this average score was slightly less than the average of all 68 forecasters in our study. In short, there is no evidence whatsoever in these data that technical analysis is effective in predicting markets. If anything, our results must be on the optimistic side, because of the well-known survivorship bias phenomenon — very likely numerous unsuccessful technical analysis practitioners have dropped out of the business, and thus are absent from our tables.

- Research studies by other analysts. We are hardly alone in concluding that technical analysis does not work. Market analyst Laszlo Birinyi, for instance, interviewed in the book The Heretics of Finance, declared, rather bluntly, “The truth is technical analysis doesn’t work in the market.”

- Multiple testing errors and cherry picking biases. Technical analysts can cite some successes, but statistically speaking, how “real” are these? As we showed in the earlier Mathematical Investor article, many of these claims fall prey to multiple testing errors and cherry picking biases. And as we mentioned in the introduction above, the American Statistical Association recently released a statement condemning “p-hacking,” which is exactly the same practice — trying numerous hypotheses, or searching thousands or millions of possibilities on a computer, and only highlighting or publishing the one or a handful of cases that look the best. This is the essence of backtest overfitting in finance — see P-hacking and backtest overfitting.

- Fundamental considerations of modern high-tech markets. Nowadays most financial markets are dominated by high-tech trading operations. In particular, large quantitative finance organizations employ highly sophisticated mathematical algorithms (vastly more sophisticated and extensive than techniques used in the technical analysis world), with huge dynamic datasets, implemented on state-of-the-art large-scale computer equipment, and trading at millisecond and even microsecond levels. Increasingly these are the only organizations that consistently make money — see, for instance, this article.

Furthermore, these organizations and their operational computer programs are engaged in a very real “arms race,” because any strategy that works is quickly mimicked by other programs from other organizations, so that any “edge” evaporates rather rapidly. Indeed, this “war” partly explains why the resulting market price stream is almost entirely a random walk.

So those who promote technical analysis would have us believe that the many highly trained mathematicians and their highly sophisticated computer programs have all somehow missed a few simple, elementary schemes that anyone armed with a laptop, a plotting program and a handful of simple tools can routinely take advantage of to produce reliable above-market-average profits. Obviously there cannot be any such simple schemes.

Individual investors and technical analysis

Given that the majority of professional traders and trading operations now recognize that traditional technical analysis does not work, why should one care about the prevalence of technical analysis-related material on brokerage sites and in financial news outlets? The problem is that many individual investors in particular have been convinced that technical analysis is the way “smart,” “high-tech” investors succeed in today’s market. As one of the quotes in the brokerage/media section above promises, technical analysis “can help you identify possible entry and exit points for trades and may help you achieve your investing goals.”

What’s more, as the quote about “entry and exit points” makes clear, technical analysis is closely coupled with market timing. But the overwhelming consensus of professional analysts is that market timing is a VERY BAD STRATEGY for individual investors, especially those with personal savings and retirement accounts. During periods of market instability in particular, far too many individual investors sell out significant portions of their portfolio in a panic just before or after the market prices hit bottom, only then to miss a substantial rebound. Such failures of market timing are multiplied by the millions in the investment world, and account for a significant fraction of the chronic poor performance of individual investors — see these Mathematical Investor articles: Poor investor performance: What can be done? and The folly of panic selling.

In short, technical analysis-based strategies are at best ineffective and potentially disastrous, particularly for individual investors. As one of us wrote in a Forbes interview, “[Technical analysis strategies] encourage traders and investors to put their money to work, while offering guidance with no objective information value.” If similarly ineffective data analysis techniques were employed in the medical or pharmaceutical world, lawsuits would be filed.

What will the future hold?

There is some hope on the horizon, with a growing recognition of the success of state-of-the-art quantitative finance and machine learning methods (see this recent book by Marcos Lopez de Prado). Additionally, analysts with real-world quant and machine learning skills are in high demand — see What is the best training for finance PhDs. Along this line, a colleague of the present author notes:

At one time, when I started doing recruitment at [a hedge fund], it was common — and acceptable — for candidates to tout their technical analysis skills. Now, at the various firms where I have worked, that would pretty well disqualify them on the spot. When I recently spoke to a national group of active investment managers, I saw a similar shift in a constructive direction.

But it is also important, just for the credibility of the mathematical finance field, that more knowledgeable financial professionals are willing to publicly declare “The emperor has no clothes!” when they see material promoting techniques such as technical analysis that are clearly ineffective or out of date. As the present author and colleagues explained in a 2014 paper, Our silence is consent, making us accomplices in these abuses.

[Updated 5 Mar 2023.]