Target-date funds

“Target-date funds” are currently the rage in the finance world. The term refers to a mutual fund that targets a given retirement date, and then steadily shifts the allocation of assets from, say, a 80%/20% mix of stocks and bonds at the start to, say, a 30%/70% mix as the target date approaches.

“Target-date funds” are currently the rage in the finance world. The term refers to a mutual fund that targets a given retirement date, and then steadily shifts the allocation of assets from, say, a 80%/20% mix of stocks and bonds at the start to, say, a 30%/70% mix as the target date approaches.

Vanguard Group, which manages over USD$5 trillion in assets, much of it in employer-offered defined contribution retirement plans, reports that participation in its target date offerings have grown explosively in the past few years. In 2005, when Vanguard started offering target-date funds, only a few of their contracting organizations offered them, and only about 2% of covered individuals participated. Today, by contrast, over 90% of their contracting organizations offer target-date funds, and over 75% of plan participants are using them. Over half of participants currently invest their entire account in a single target-date fund, and Vanguard expects that this figure will rise to 70% by 2022.

Separately, Paladin Research projects that the USD$2.5 trillion currently in target-date funds in the U.S. will grow by 2020 to USD$4 trillion and will comprise nearly 50% of all 401(k) assets.

Part of the appeal of target-date funds, both to individual consumers and financial advisors, is their simplicity — they offer a one-stop, set-it-and-forget-it approach to retirement savings. Rather than cobble together a portfolio of several funds or ETFs, one can throw everything into a single target-date fund and leave it.

Some have hoped that the simplicity and all-inclusiveness of target-date funds would encourage participants to be more consistent with their investment. However, as Bloomberg columnist Nir Kaissar has observed (based on Morningstar data), individual investors in a set of 154 target-date funds lagged their fund’s performance by an average of 0.83% per year over the five years ending in June 2018, a shortfall very likely due to panic selling and/or ill-fated attempts to time the market.

In any event, before everyone rushes out to invest their retirement nest eggs in target-date funds, maybe it is time to ask some hard questions.

A question of fees

To begin with, there is the question of fees — the annual management fee deducted from the fund’s overall performance. Nir Kaissar analyzed 227 retirement target-date funds with at least USD$100 million in net assets. He found that the average expense ratio of these funds was 0.67%; if averaged over total assets, the figure is 0.58%. Needless to say, in today’s competitive finance world such rates are disappointingly high.

Such high fees should not be necessary, even under the constraint of the target-date funds concept. Vanduard’s institutional target-date funds, for instance, charge only 0.09%. But even 0.09% is higher than many broad-market index funds and exchange-traded funds. The Vanguard S&P 500 ETF charges just 0.04%; the Schwab U.S. Broad Market ETF charges just 0.03%; and the iShares Core S&P Total US Stock Market ETF charges just 0.03%.

So are target-date funds really so much better? Do they really justify the higher fees?

Kaissar simulated a target-date portfolio, starting with a portfolio that allocated 80% to an S&P 500 index fund and 20% to long-term U.S. government bonds, and then each year reduced the stock allocation by 1% and increased the bond allocation by 1%, so that after 41 years it was a 40/60 mix. Kaissar then compared this strategy with a static 60/40 ratio, over every 41-year period from 1926 to 2017. The average returns were identical, to within 0.1% per year.

Needless to say, if one simply invests in a static 60/40 portfolio, one can find management fees much lower than the target-date offerings. But even if one applies the target-date concept, manually adjusting one’s allocation once a year (hardly an onerous chore), one can obtain the same performance as a target-date fund, at much lower cost.

Do fees matter? You bet they do. Over the 41-year period from January 1977 through December 2017, the S&P 500 (with reinvested dividends) rose by a factor of 27.676, for an average annualized yield of 8.436%. If one selects an S&P 500 index-tracking fund that charges 0.04%, so that the net annualized rate is 8.396%, a $10,000 initial investment would have grown to some $272,600 over the 41-year period, whereas with a fee of 0.67%, the net annualized rate would be 7.766% and the final balance would be $214,600, a shortfall of $58,000 or 21%.

Will target-date investors outlive their savings?

Even setting aside for a moment the question of fees, the rise of target-date funds raises the question of what is really the best balance of investments between equities and bonds, and how this mix should change over an individual’s career or lifetime.

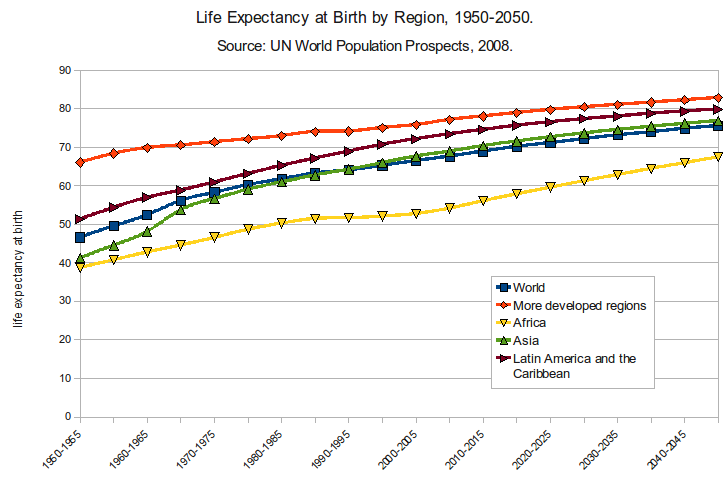

The key statistic here is life expectancy. In the U.S., although there have been some reversals, life expectancy has risen fairly steadily, from 67(M)/72(F) in 1950 to 76(M)/81(F) in 2017. The U.S. Social Security Administration and the Census Bureau estimate that by 2050, women’s life expectancy will rise to 83-85, and men’s to 80. A separate study by the MacArthur Research Network estimates even higher U.S. figures: 89-94 for women and 83-86 for men. Life expectancy figures are generally even higher in other first-world nations than in the U.S. (84 in Hong Kong, Japan and Italy, for example), and are similarly projected to increase steadily for the foreseeable future.

It is worth emphasizing that many alive today will live to 100 and beyond. In the U.S., the over-100 age bracket is expected to hit 6 million by 2050, growing 20 times as fast as the overall population.

Given these life expectancy projections, we need to ask whether most target-date strategies, typically an equity/bond mix varying from 80/20 at the start to 40/60, 30/70 or even 20/80 at the target retirement date, really make sense in today’s world. Aren’t these figures, which are so commonly used in the investment world, a bit out of date?

A person who retires at 65, and who expects to live to 85, will have to subsist for 20 years on savings, supplemented as usual by some Social Security benefits or the equivalent in other countries. But given current projections, he or she might well be so fortunate as to live to 95 or 100, which is 35 years on savings. Even if someone decides not to retire at 65, but instead waits until 70, he or she may spend 30 years living on retirement savings. His or her savings will not only have to last much longer, they will need to continue growing for a very long time.

Thus perhaps investors should be advised to remain in a mostly-equity portfolio longer into their careers and, depending on circumstances, perhaps even after retirement. One can never guarantee that current equity returns will continue indefinitely in the future, but given over a century of experience in modern western financial markets, the compounded return of equities with reinvested dividends very likely will exceed that of a bond-dominated portfolio over any reasonably long-term horizon.

S&P 500 (blue), 40/60 stock-bond mix (orange), and all 5% bond (green)

Note that the S&P 500 investment grows to $276,000, whereas the 40/60 mix only reaches $157,000, a shortfall of $119,000 or 43%. The all-bond portfolio only reaches $77,000, a shortfall of $199,000 or 72%. These are not minor differences!

Summary

In short, there are definite reasons to be concerned that in the mad rush to target-date funds, some important issues are not being addressed.

The question of fees is paramount. Target-date funds are not all created equal. Some offerings have substantially greater fees than others, and even those with relatively low fees are significantly more expensive than many broad-market index-tracking funds available from major brokerages and investment firms.

A second question is whether target-date funds, aside from their appealing simplicity, really add value. As noted above, a static 60/40 mix of an S&P 500 index fund and U.S. government bonds would have given essentially the same long-term performance as a simulated target-date fund over recent 41-year periods.

The third question is the larger issue of whether the formula used by most target-date funds, namely to start out with, say, a 80/20 mix of equities and bonds, and then shift, say, to a 40/60, 30/70 or 20/80 mix by retirement, really makes sense in a world where life expectancies are projected to steadily increase for the foreseeable future. Given current longevity projections, which show that a significant fraction of the population will live into their 90s or beyond, many target-date investors will outlive their savings.

So maybe it is time to ask the hard questions before the current stampede to target-date funds becomes irreversible. It may be your ox that gets gored.