Target date funds and formulas for retirement

As we explained in an earlier Mathematical Investor blog, “target-date funds” are currently the rage in the finance world. The term refers to a mutual fund that targets a given retirement date, and then steadily shifts the allocation of assets from, say, a 80%/20% mix of stocks and bonds at the start to, say, a 30%/70% or 20%/80% mix as the target date approaches.

Vanguard Group, which manages over USD$5 trillion in assets, much of it in employer-offered defined contribution retirement plans, reports that participation in its target date offerings have grown explosively in the past few years. In 2005, when Vanguard started offering target-date funds, only a few of their contracting organizations offered them, and only about 2% of covered individuals participated. Today, by contrast, over 90% of their contracting organizations offer target-date funds, and over 75% of plan participants are using them. Over half of participants currently invest their entire account in a single target-date fund, and Vanguard expects that this figure will rise to 70% by 2022.

Separately, Paladin Research projects that the USD$2.5 trillion currently in target-date funds in the U.S. will grow by 2020 to USD$4 trillion and will comprise nearly 50% of all 401(k) assets.

The rise of target-date funds raises the question of what is really the best balance of investments between equities and bonds, and how this mix should change over an individual’s career or lifetime. One commonly used rule is that the percentage of one’s portfolio allocated to equities should not exceed 100 minus one’s age. Thus while a 20-year-old could invest 80% of his/her savings in stocks, this should not exceed 30% by the time one reaches 70. Some have suggested replacing 100 by a higher figure, such as 110, but others argue that it should be reduced.

So whether or not one invests in a target-date fund, what should be the proper portfolio balance at different stages of life?

Life expectancy statistics

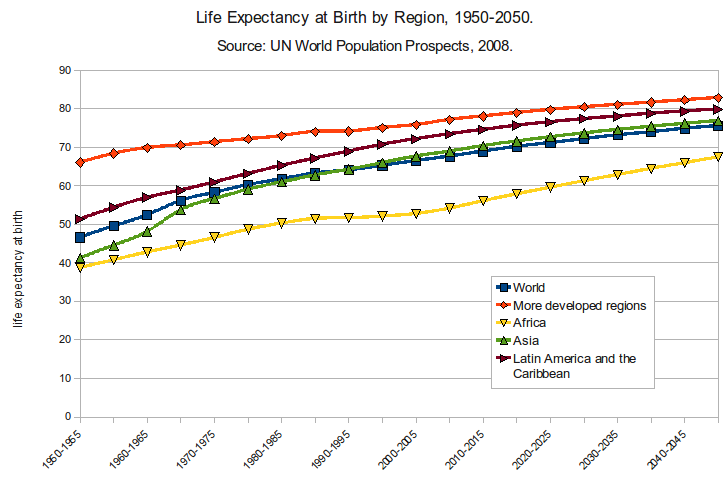

One key statistic here is life expectancy. We often forget how much human life expectancy has already increased. After all, worldwide life average expectancy has soared from 29 as recently as 1880 to 72 today (see also [Pinker2018, Chap. 5]). No, “72” is not a misprint — it is the current average worldwide life expectancy, averaged over poor nations as well as rich, according to a UN report. Virtually every nation for which reliable statistics are available has seen a significant rise in life expectancy over the past 30 years (see graph above).

In the U.S., although there have been some reversals, life expectancy has risen fairly steadily, from 67(males)/72(female) in 1950 to 76(males)/81(females) in 2018. The U.S. Social Security Administration and the Census Bureau estimate that by 2050, the life expectancy of females will rise to 83-85, and that of males will rise to 80. A separate study by the MacArthur Research Network estimates even higher U.S. figures: 89-94 for women and 83-86 for men.

Life expectancy figures are somewhat higher in most other first-world nations. For example, 2018 life expectancy figures for Canada are 80(males)/84(females). The figures for other first-world nations are comparable or even higher (84 in Hong Kong, Japan and Italy, for example). As with the U.S., these figures are projected to increase steadily for the foreseeable future.

It is worth emphasizing that even given relatively conservative projections of longevity, it is clear that an increasing fraction of humanity will live to 100 and beyond. In the U.S., the over-100 age bracket is expected to hit 6 million by 2050, growing 20 times as fast as the overall population.

Longevity research

While not yet widely recognized, numerous research organizations are looking into the mechanisms of aging and death, with the bold long-term objective of not just accepting these eventualities as inevitable consequences of mortality, but instead as merely technical “bugs” awaiting fixes.

Google, for instance, has allocated hundreds of millions of dollars to fund an anti-aging spinout named Calico. Its mission statement reads:

Calico is a research and development company whose mission is to harness advanced technologies to increase our understanding of the biology that controls lifespan. We will use that knowledge to devise interventions that enable people to lead longer and healthier lives. Executing on this mission will require an unprecedented level of interdisciplinary effort and a long-term focus for which funding is already in place.

Calico is led by noted longevity researcher Cynthia Kenyon, who 20 years ago showed that by merely altering a single DNA letter in its genome, a laboratory roundworm could live six weeks instead of just three.

Amazon CEO Jeff Bezos has joined other investors to fund Unity, a San Francisco startup developing drugs aiming at ridding the body of “senescent” cells. Along this line, researchers recently found that a “cocktail” of three drugs appeared to rejuvenate the human body, stopping or turning back certain biological clocks (see also this New Scientist report).

Some researchers are even more expansive, saying that it is inevitable that aging and death will eventually be conquered. As Israeli scholar Yuval Harari recently wrote [Harari2015], by 2050 some humans may become a-mortal, in the sense that in the absence of fatal trauma their lives could be extended indefinitely.

At present, we have no way of knowing how soon these research efforts will truly pan out. But given all of the activity in this arena, it seems very foolish to dismiss or reject the possibility of significant breakthroughs that could drastically change modern society.

Financial consequences of increasing longevity

Given even the more conservative projections of life expectancy, it is clear that we need to start asking some hard questions about prevailing investment rules (e.g., the 100% minus age for equities rule) and similar target-date strategies (e.g., an equity/bond mix varying from 80/20 at the start to 30/70 or even 20/80 at the target retirement date). Do these rules, which are so commonly used in the investment world, really make sense in today’s world of rapidly advancing science and technology?

After all, a person who retires at 65, and who expects to live to 85, will have to subsist for 20 years on savings, supplemented as usual by some Social Security benefits or the equivalent in other countries. But given current projections, he or she might well be so fortunate as to live to 95 or 100, which is 35 years on savings. Even if someone decides not to retire at 65, but instead waits until 70, he or she may spend 30 years or more living on retirement savings. His or her savings will not only have to last much longer, but will need to continue growing, possibly for a very long time, to meet the saver’s expected financial requirements.

The recent financial independence / retire early (FIRE) movement raises some closely related issues. FIRE refers to the plans of a small but growing fraction of the public to live relatively meagerly, save a large fraction of their income, and then retire when their nest egg is, say, 25 times as large as a basic living income, hopefully at a rather young age, such as 35 or 40. There are numerous issues with such a plan, including: (a) one would forfeit much if not most of a normal Social Security benefit or its equivalent in other nations; (b) it may be necessary to relocate to a very low cost-of-living (and perhaps not particularly desirable) locale, possibly even in a second- or third-tier nation; (c) raising a family and supporting children through college may be out of the question; (d) one may need to forego the possibility of world travel and other common perks of retirement; and (e) one may need to deal with known mental health issues in having lots of time and relatively little meaningful, challenging work to do (lay on a beach all day?).

But a larger concern, in an era of steadily increasing longevity, is that a person “retiring” in one’s 30s or 40s will need to rely on savings not just 25 years, but possibly 50, 60, 70 or more years. Is this a truly realistic plan, particularly if one’s nest egg is invested relatively conservatively?

Time to rethink the equity/bond mix formulas?

Given any of the above considerations, let alone all of them, it seems clear that both individual and institutional investors need to reconsider their investment portfolios in light of the emerging brave new world where people live significantly longer than they do today.

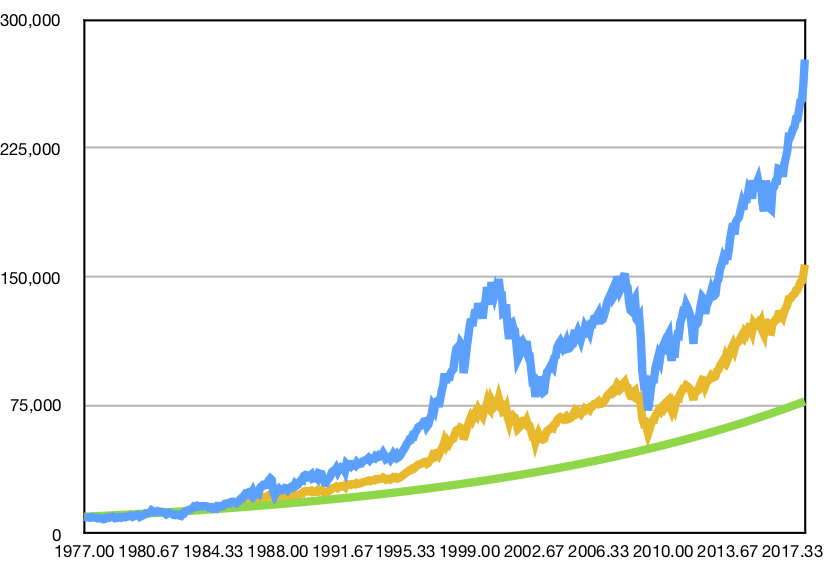

S&P 500 (blue), 40/60 stock-bond mix (orange), and all 5% bond (green)

The graph at the right compares the growth of a $10,000 investment in an S&P 500 index fund with reinvested dividends (blue); a 40/60 mix of an S&P 500 index fund and 5% bonds (orange), and a portfolio of entirely 5% bonds (green), which for simplicity we will assume accrues 5/12% interest per month compounded, with no other capital rise or fall. Each of these is shown for the 41-year period from January 1977 through December 2017.

Note that the S&P 500 investment grows to $276,000, whereas the 40/60 mix only reaches $157,000, a shortfall of $119,000 or 43%. The all-bond portfolio only reaches $77,000, a shortfall of $199,000 or 72%.

These are not minor differences, and these are not minor issues. How individuals, pensions, mutual funds and even government retirement systems (e.g., Social Security) deal with the phenomenon of increasing longevity may well emerge as one of the most important long-term issues of our time.