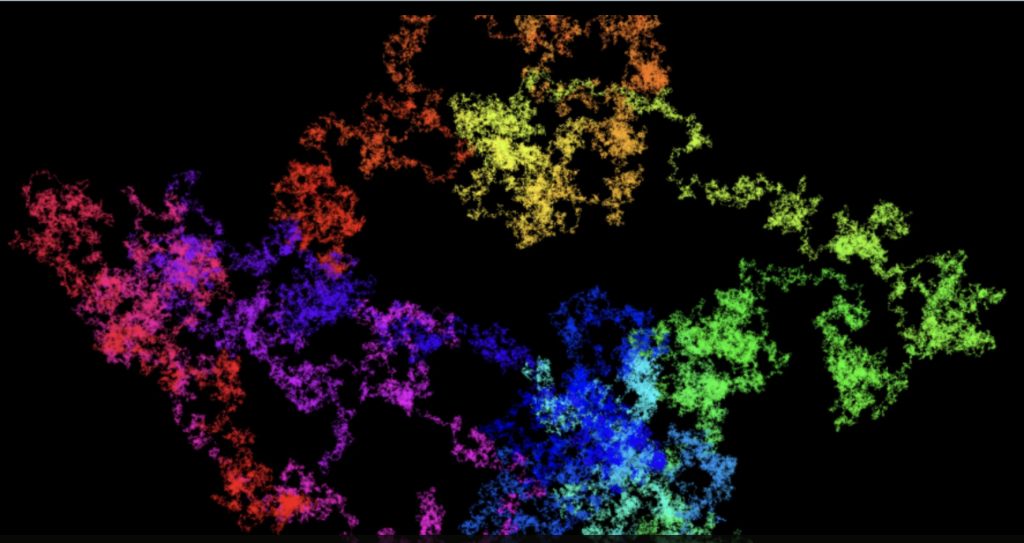

A random walk on the base-4 digits of pi (see http://gigapan.com/gigapans/106803)

A Random Walk Down Wall Street

Fifty years ago, Princeton economics professor Burton Malkiel published A Random Walk Down Wall Street. He boldly asserted that a blindfolded chimpanzee throwing darts could pick a stock portfolio that would do as well as one created by many expert practitioners in the field.

At the time, Malkiel envisioned a strategy of owning a broad-based set of stocks, saying mimicking a major stock index such as the U.S. Standard and Poor’s 500 index (S&P 500). At the time, such investment vehicles did not exist. Fast-forward 50 years, and now some $5.7 trillion is invested in U.S. index funds, with similarly large sums in other major international markets.

In a recent Bloomberg News interview, Malkiel argues that the case for passive, index-linked investing is stronger than ever, particularly for individual investors with their long-term savings and 401K accounts.

Some have argued (see for example the above interview) that active investing shines during stagnant or declining markets. But Malkiel points out that whereas conventional mutual funds must maintain a cash reserve, typically 5% of assets, to handle client redemptions, in contrast most index funds offset their cash reserves with futures contracts, so that they remain virtually 100% invested in their respective index.

How well do active funds perform in U.S. markets?

Arguably the best source of information on the performance of U.S. actively managed funds, as compared with their comparable index equivalents, is the Morningstar Barometer report. Here are some data from the latest report (as of 31 Dec 2022):

| Percentage of actively managed U.S. equity funds beating the comparable index | |||||

|---|---|---|---|---|---|

| Category | 1-year | 3-year | 5-year | 10-year | |

| Large blend | 54.1% | 38.1% | 30.1% | 13.1% | |

| Large value | 47.2% | 41.5% | 30.9% | 11.4% | |

| Large growth | 37.5% | 23.4% | 21.6% | 7.0% | |

| Mid blend | 50.5% | 46.5% | 31.6% | 18.1% | |

| Mid value | 39.6% | 50.5% | 31.5% | 4.6% | |

| Mid growth | 46.5% | 47.7% | 60.1% | 39.8% | |

| Small blend | 52.9% | 52.6% | 34.7% | 27.2% | |

| Small value | 61.0% | 44.2% | 43.8% | 32.7% | |

| Small growth | 56.9% | 50.3% | 57.6% | 46.4% | |

How well do active funds perform internationally?

A good source on the performance of active versus index funds in international markets is the “Standard and Poors Index Versus Active” (SPIVA) Scorecard. Here are some of the latest data from various international markets (as of 7 Mar 2023):

| Percentage of actively managed equity funds beating the index | |||||

|---|---|---|---|---|---|

| Market | Index | 1-year | 3-year | 5-year | 10-year |

| United States | S&P 500 | 48.92% | 25.73% | 13.49% | 8.59% |

| Canada | S&P TSX Comp | 57.53% | 16.67% | 3.61% | 17.71% |

| Europe | S&P Europe 350 | 11.16% | 20.19% | 12.23% | 12.19% |

| Japan | S&P TOPIX 150 | 24.35% | 23.60% | 16.06% | 13.82% |

| Australia | S&P ASX 200 | 52.13% | 49.70% | 26.38% | 22.77% |

| Brazil | S&P Brazil BMI | 42.46% | 30.80% | 21.14% | 11.51% |

| Middle East / North Africa | S&P Pan Arab Comp | 47.83% | 36.67% | 8.82% | 8.57% |

Analysis

Needless to say, these results are pretty grim for actively managed equity funds — almost all entries of the table are less than 50%. Indeed, the only equity categories exceeding 50% success beyond one year are U.S. mid value (3-year), U.S. mid growth (5-year), U.S. small blend (3-year) and U.S. small growth (3-year and 5-year). In NONE of the categories, U.S. or international, did the active funds outperform their index benchmark over a 10-year time horizon. Additional data can be seen in the Morningstar report.

We should add that if anything, the above results are optimistic for the actively managed funds, because of the well-known survivorship bias phenomenon. Note that for an active fund to be included in any of the above tabulations, it must have at least survived over the period in question. Presumably almost all of the funds that did not survive had below-par performance.

Does indexing threaten the market?

One question that often arises in this context is whether growing numbers of passive, index-linked funds pose a long-term threat to financial markets — see for example this Barron’s report and this Institutional Investor report.

Some observers are concerned that index investing may lead to market inefficiencies, since index funds typically purchase securities without consideration of potential underlying strengths and weaknesses of individual components. Others are concerned that index investing may emphasize certain firms and sectors at the expense of others. For example, it is well-known that major indices such as the S&P 500 index are rather heavily weighted with large technology firms such as Apple, Google, Meta and Microsoft (although as Malkiel observes, most actively managed portfolios have similarly large weightings with the large tech firms). There is also concern about a self-fulfilling prophecy effect — the relatively good performance of the leading index funds in recent years might be attracting investors to these funds who may dump them in a downturn.

Finally, there is a very real concern that many of the newly minted exchange-traded index funds might not be truly independent of the creation of the index, or that the index was designed using a statistically overfit computer search. For example, a 2015 study found that recently minted U.S. exchange-traded equity index funds scored a 5% average annual excess (above-market) yield before launch, based on backtest analysis, but a 0% average annual excess yield after launch. See this SSRN report or this Significance article for further details.

In February 2018, Brad Steiman of Dimensional Fund Advisors Canada published an analysis of whether indexing has led to a less efficient market in the intervening years. If this is true, then active managers should, on average, achieve increasingly better results, by exploiting inefficiencies that are indirect results of indexing. To that end, he analyzed the average performance of actively managed U.S. funds from 2004 through 2016, relative to their Morningstar category benchmark. He found that this ratio has been remarkably stable during this period, mostly varying between 30% (in 2012) and 39% (in 2013). Needless to say, these data do not support the increasing inefficiency hypothesis.

Steiman also analyzed the extent to which S&P 500 stocks move in lockstep. He exhibited a histogram of the range of S&P 500 index component returns in 2017. These data varied very widely, ranging from +133.7% to -84.0%. Amazon was typical of the above-average gainers, with a 56.0% gain; General Electric was typical of the losers, with a 42.9% decline. Again, such a wide variation in performance is not consistent with the claim that indexing has led to inefficient lockstep behavior of the S&P 500 component stocks.

Conclusion

As we have seen above, the latest data confirm that actively managed mutual funds are struggling to match passive, index-linked equivalents. In other words, relatively few active managers are able to consistently beat the corresponding passive benchmarks over the long term. Thus we can expect more assets to move into index-linked instruments in the future.

But concerns that indexing is leading to serious market inefficiencies, or that indexing threatens the stability of markets, appear to be overblown. To the contrary, there is reason to believe that greater levels of indexing may provide increased opportunities for active managers, say in exploiting fundamental weaknesses inherent in index investing. Thus while the index situation is worth monitoring, it does not appear to pose major difficulties for the time being.

So what do leading experts in the field recommend, particularly for individual investors with their 401K and IRA accounts? As we have emphasized before in these articles, the majority of individual investors would do well to simply follow the advice of Vanguard Funds founder Jack Bogle, Berkshire Hathaway founder Warren Buffett and Dimensional Fund Advisors co-founder David Booth: invest in one or a handful of low-cost index funds (or, alternatively, a modest-sized diverse collection of individual stocks and/or bonds), selected according to a sober analysis of appropriate risk and time frame, perhaps with the assistance of a qualified professional, and, most importantly, hold these investments for the long term — studiously avoiding the temptation to buy or sell based on day-to-day market fluctuations or commentaries.

As David Booth commented, “We don’t try to forecast the future. … We have no ability to do it. Nor does anyone else.”