Bravery or recklessness?

Investing is often referred to as an Art: The Art of Investing. True artists may object to this analogy, but, in any event, the key implication is that quantitative methods have a very limited applicability to investment problems, and mathematical (i.e., formally rigorous and logical) arguments are essentially misguided. Proponents of this philosophy often assert that investing is just too complex, with too many free variables, for mathematical methods to be of much use. But aren’t biological, chemical or nuclear systems also complex, and yet Mathematics has become the indispensable tool to understand them?

Every human activity may be approached as an artistic endeavor. For example, many people think of archery as an art, and practice it for its relaxing and entertaining properties. Olympic athletes approach it differently. They use high-tech materials, biomedical devices that take into account their bodily conditions, and atmospheric devices to incorporate environmental readings. They also follow a strict algorithmic procedure to assess the accuracy of a shot and correct the observed error to make the next shot more accurate.

In a similar way, one could go to Las Vegas and play the art of beating the casino: Gambling. Casinos love gamblers. Like artists, they are passionate, fashionable, unpredictable, mystic, and, most importantly, unsystematic. Such players may enjoy epic wins, but eventually most of them lose it all (and then some), and the casino emerges with a tidy profit. In contrast, casinos have a system, which is the backbone of their business, and they follow it strictly and scientifically. Casinos are afraid of mathematicians, like Edward Oakley Thorp, John Larry Kelly, James Grosjean, … who are not allowed to enter their establishments.

Flying to the moon like Chang’e in the Chinese mythology was wishful-thinking, yet it takes a rigorous scientific program like Apollo to make it a reality. Columbus’ daring attempt to reach India and Elcano’s first circumnavigation of the globe (the same trip that cost Magellan’s life) were heroic. It was brave to embark on odysseys in the pre-technological era. But it would be downright reckless to rely on “bravery” in 21st century, given the progress we have made since then. Our pre-technological ancestors had no choice, but we do.

The science of investing

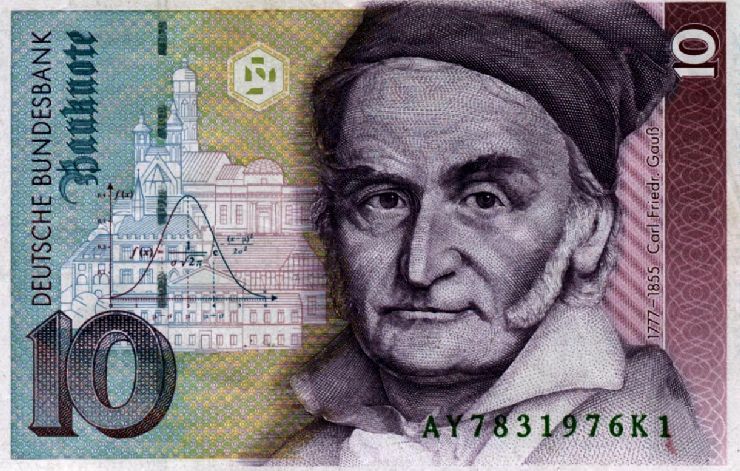

As human understanding has deepened, many former arts have become sciences: alchemy gave way to chemistry; astrology gave way to astronomy; gambling gave way to game theory; bloodletting and wizardry gave way to high-tech science-based medicine; and medieval numerology gave way to the towering edifice of modern mathematics. Thus it is inevitable that the art of investing give way to the science of investing.

There are, indeed, excellent discretionary traders, who use their intuition in ways that we (and they) don’t fully understand (hence their discretionary decision-making). However, without the support of science they are like the endeavors of Columbus, Elcano and Magellan. Consider, for example, Jesse Livermore, the “great bear of Wall Street.” An investor of enormous talent, Livermore nonetheless made and lost four fortunes in his life and tragically died broke. For every instance of spectacular success from this approach there is also an instance of spectacular failure.

Mathematical finance does not dismiss the expertise gathered by discretionary traders over decades of experience. On the contrary, it levers from that expertise: developing disciplined, scientific algorithmic systems that replicate the decisions of discretionary traders, and then applying that insight in a more general and scalable way to yield even more successful trading systems, while avoiding the risk inherent in an intuition-only approach.

For example, financial mathematicians construct overlay portfolios based on the bets implied by those discretionary managers, thus measurably increasing the degree of diversification in a portfolio. It also provides ways to assess the skill of those discretionary traders, and many more applications that we will explore in technical articles and this blog. But the modern discipline of mathematical finance recognizes the limitations of purely intuition-based investment strategies. Intuition can be surprisingly effective; but it can also be very wrong. A science-based approach is the best a rational investor can do.

A compromise

Mathematical finance does not seek to end the role of “artistic” traders and “discretionary” portfolio managers. Far from it. Instead, it develops quantitative portfolio oversight methods that incorporate the “artistic” input from discretionary traders into a scientific framework, thus delivering a systematic-style investment that benefits from their intuition while avoiding the very real risk of catastrophic performance. Financial mathematics is a young emerging discipline of science. Like her elder siblings she needs the nurture of an educated mass. As investors in the 21th century we need to rise to the challenge: educate ourselves and demand increasing rigor from financial researchers and practitioners.

Indeed, it is just as important to be aware of the dangers of blind quantification as it is to eschew quantitative analysis. For example, financial managers’ blind reliance on over-simplified mathematical models arguably contributed to the recent financial crash. They presumed that markets behave according to conventional Gaussian distributions, when in fact they do not always behave that way, particularly in extreme regimes. See Nobel Laureate (and New York Times columnist) Paul Krugman’s excellent 2009 analysis of the financial crisis for additional details.

For additional discussion, see our blogs The Two Towers of Finance, which discusses the disconnect between the academic and practitioner arenas of finance, and Two tales of the Kelly formula, which discusses how the Kelly formula can be used (or misused) in finance.